The atmosphere during the game was very friendly and supportive. Yes, their payoff was great, but the chances of them being a success were not high enough for me. I would not participate in a very risky businesses. When looking at new investment opportunities I would calculate ROI (return on investment) and compare it with my previous investments and my other options, such as paying off some debt. I calculated interest rates on all my debt (loans, mortgage, credit cards, etc.).

However I have always thought that I would take much more risk in a game (as I am not playing with real money). My passive income was much higher than of other players, and so were my expenses.Īs you play you are learning more about yourself, your financial style and financial styles of other players. Unfortunately, I could not get out the Rat Race during our 3-hour playing window. It has two zones: first you are in the Rat Race, and if you have managed to cover your expenses with passive income - bingo - you are in the Fast Track.

#Cashflow 101 game strategies how to

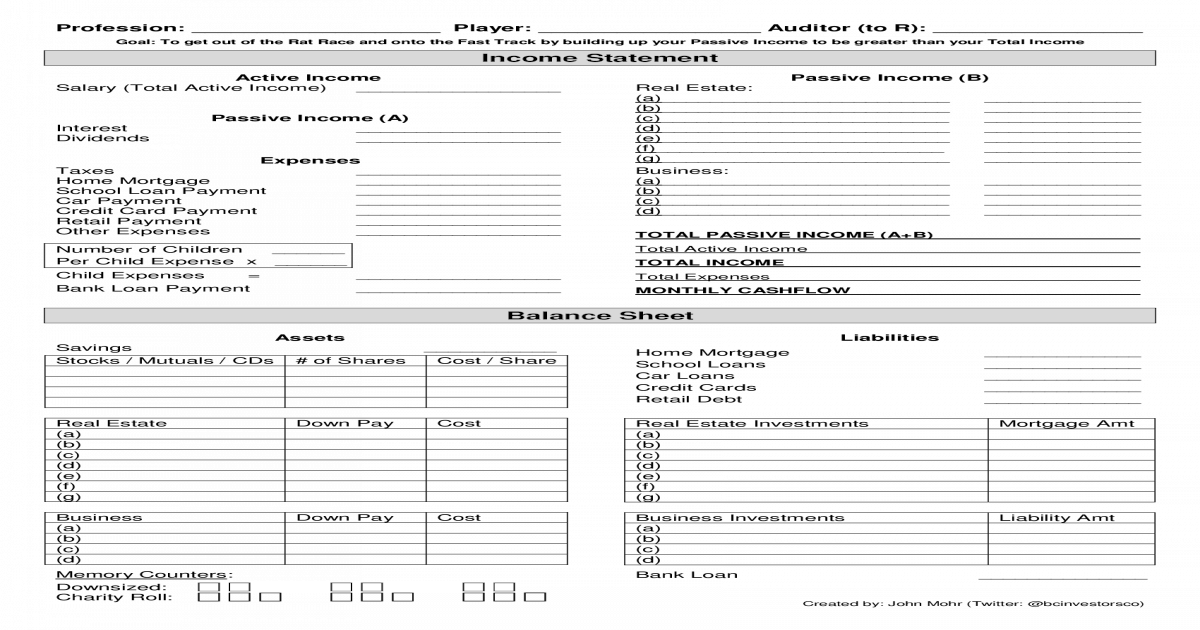

The CASHFLOW game helps to understand how to build private wealth. I will share my key takeaways from this book later. Dina observed our behaviour during the game and shared a lot of insights at the end.Īs a proper student, first, I have read a book "Rich Dad Poor Dad" to understand the environment around the game. Dina is a great coach who helps people to transform their lives, and I am very grateful that I have met her in my life. It all started when I decided to join the CASHFLOW game event organised by Dina Goncharova. This game is the ultimate realization of Robert Kiyosaki's vision for an interactive tool to teach investing and wealth building." "CASHFLOW was developed by renowned entrepreneur and motivational speaker Robert Kiyosaki, author of the bestselling personal finance book of all time, Rich Dad Poor Dad. Practice helps, however how to practise investing?! but sad to say, your cashflow from this property doesn't change.Learning is fun for me, however reading or listening to various materials is not enough. if you want to get rid of your mortgage loan from investment property, you just have to pay it off for the whole sum. Furthermore, to simplify the process of CASHFLOW game, you don't have to care about the loan reduction every month. so your principal amount wouldn't change. If you buy property in real life, you will start to realise in the 1st 10 (maybe even more) years, you are not repaying the principal of the loan. therefore you don't have to worry about adding bank loan payment, btw we don't call this bank loan, we call it mortgage loan as it is secured with the property you bought.Ģ) now comes to why the loan is not reduced after month by month you are paying the loan. so in this case for the real property, it is a net profit you get from this property after deduction of mortgage payment (and some other misc expenses). You would have to take a $1,000 bank loan and add $100 to your expense column.īut I think the following answer explained more in details:ġ) Why there is no bank loan payment while there is a mortgage attach with the property?Ģ) Why the mortgage loan is not reduce along the way?ġ) first you need to understand the property you bought, Why the card say Cashflow +$140, why it don't say "income +$140" or "rental +$140"? why cashflow?Ĭashflow means income minus expenses. So, as an example, let's say that you only have $3,000 in cash and you want to buy the deal. You only have to record a bank loan in your liabilities and expense columns if you don't have enough cash to make the down payment in the game with the cash that you have on hand. This is where it gets me, because aren't you supposed to put the bank loan payment in as well? To keep my total expenses down, wouldn't I have keep paying off my bank loan? And wouldn't this in turn lessen my mortgage amount in the liabilities column? Really going round in circles here, cause I looked in the rules book for cashflow 101 at their example. I'm basing this on having just bought the property.Ĭondo Down Pay: 4,000 Cost: 40.000 Mortgage: 36,000 Income Statement Condo Cashflow: 140 I get the part about where to put everything on the Game Card. Hi there, Can anyone please help me understand paying off your bank loan for a real estate property. There are commonly question ask about paying off bank loans in the Cash flow 101:

0 kommentar(er)

0 kommentar(er)